Taxes removed from paycheck

Most employees must pay Medicare and Social Security taxes therefore exemption from these taxes is rare. Use this tool to.

What Are Payroll Deductions Article

The Medicare tax rate remains 145 percent on the first 200000 of wages plus an additional 09 percent for wages above 200000.

. Youre exempt from FICA taxes if youre a student at the school that you work for or if youre a nonresident alien with a specific type of visa such as F-1 J-1 M-1 or Q-1 visas. Our Tax Relief Experts Have Resolved Billions in Tax Debt. These accounts take pre-tax money which means the money.

Ad Based On Circumstances You May Already Qualify For Tax Relief. How To Find Out The Status Of My Tax Return. If this is the case.

Find Out How EY Helps Businesses Successfully Overcome Various Tax Challenges. -Withhold 145 percent of each employees taxable pay for Medicare tax purposes until they earn a total of 200000 for the. We Can Help Suspend Collections Wage Garnishments Liens Levies and more.

You Dont Have to Face the IRS Alone. We Can Help Suspend Collections Wage Garnishments Liens Levies and more. However making pre-tax contributions will also decrease the amount of your pay that is subject to income tax.

Local Income Tax. When Should I Get My Federal Tax Return. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

How To Calculate Taxes Taken Out Of Paycheck. Washington Paycheck Quick Facts. Ad You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes.

Start Resolving IRS Issues Now. Start Resolving IRS Issues Now. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Get Free Competing Quotes From IRS Back Tax Experts. If youre considered an independent contractor there would be no federal tax withheld from your pay. Some states follow the federal tax.

However note that every pay check is expected to show. Maybe their last paycheck is Dec. In addition to federal income tax you will also have to pay state income tax and any other local income taxes like those for city or county governments.

Ad Personalized Solutions Expert Help From Start To Finish. The money also grows tax-free so that you only pay income tax when you. These accounts take pre-tax money meaning they come out of your pay before income tax is applied so they also reduce your taxable income.

There are two types of payroll taxes deducted from an employees paycheck. Get the Help You Need from Top Tax Relief Companies. Ad Dont Let the IRS Intimidate You.

In fact your employer would not withhold any tax at all. You as an employer must also pay this tax. Your marital status pay frequency wages.

If you meet the criteria for. Qualify to be exempt from federal taxes. Estimate your federal income tax withholding.

Washington income tax rate. See how your refund take-home pay or tax due are affected by withholding amount. Social Security and Medicare.

30 and thats the only opportunity that employer will have to recover those deferred taxes or else the employer will be liable for it he said. It can also be used to help fill steps 3 and 4 of a W-4 form. Ad Helping Businesses Manage Their Tax Responsibilities Through Remote Tax Tools.

We Help Taxpayers Get Relief From IRS Back Taxes. Ad Personalized Solutions Expert Help From Start To Finish. In the United States the Social Security tax rate is 62 on.

The state tax year is also 12 months but it differs from state to state.

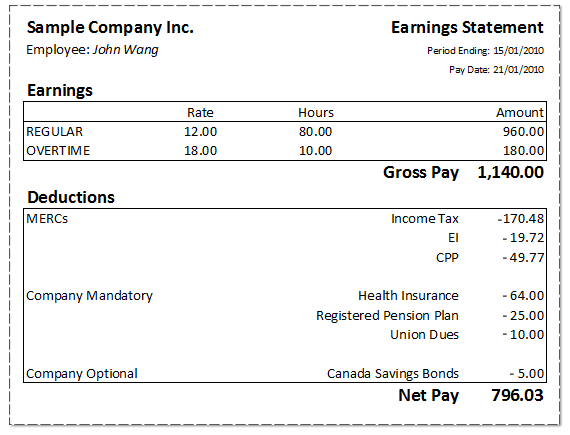

How Much Money Is Taken Of My Paycheck Part Time Job At A Grocery Market Chain In Ontario Canada Quora

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

How To Take Taxes Out Of Your Employees Paychecks With Pictures

Understanding Your Paycheck Credit Com

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Understanding Your Paycheck

My Store Is Getting The 200 Bonus In The Paycheck We Re Receiving On Friday I Was Looking At Workday And The Taxes Coming Out Of My Paycheck This Week Are 201

Is Federal Tax Not Withheld If A Paycheck Is Too Small Quora

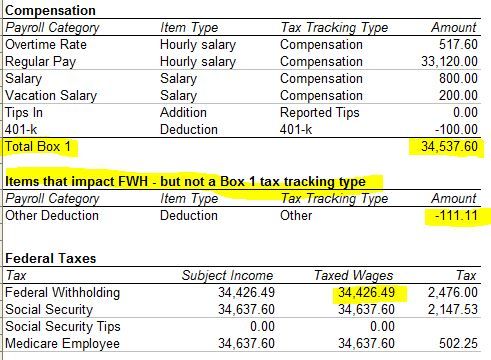

Solved W2 Box 1 Not Calculating Correctly

Paycheck Taxes Federal State Local Withholding H R Block

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

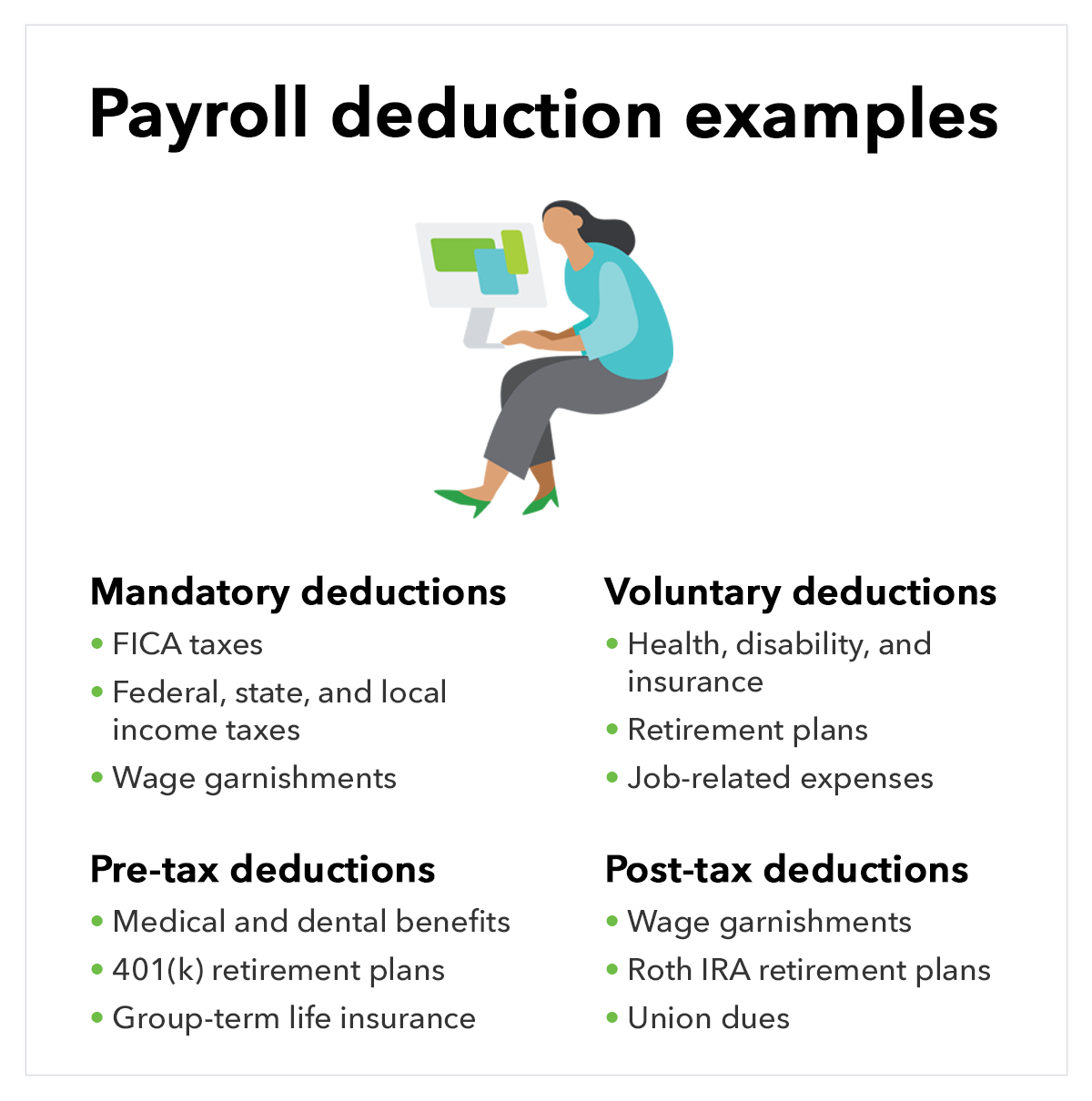

What Are Payroll Deductions Article

The Measure Of A Plan

Is An Employer Allowed To Stop Taking Federal Taxes Out Of My Paycheck So That I Can Take Advantage Of A Tax Credit Quora

How To Calculate Payroll Tax Deductions Monster Ca